The 6-Second Trick For Medicare Graham

The 6-Second Trick For Medicare Graham

Blog Article

Medicare Graham for Dummies

Table of ContentsThe Only Guide for Medicare GrahamThe Ultimate Guide To Medicare GrahamAll About Medicare GrahamMedicare Graham for DummiesEverything about Medicare GrahamMedicare Graham - TruthsFacts About Medicare Graham RevealedNot known Details About Medicare Graham

In 2024, this threshold was established at $5,030. As soon as you and your plan spend that quantity on Component D medicines, you have entered the donut opening and will pay 25% for medications going ahead. As soon as your out-of-pocket prices get to the 2nd threshold of $8,000 in 2024, you run out the donut opening, and "catastrophic coverage" starts.In 2025, the donut opening will certainly be greatly eliminated for a $2,000 restriction on out-of-pocket Component D drug investing. When you strike that threshold, you'll pay nothing else expense for the year. If you just have Medicare Components A and B, you may think about supplemental exclusive insurance to help cover your out-of-pocket costs such as copays, coinsurance, and deductibles.

While Medicare Part C functions as a choice to your original Medicare strategy, Medigap functions together with Components A and B and assists fill in any coverage voids. There are a couple of vital points to learn about Medigap. You have to have Medicare Components A and B before buying a Medigap plan, as it is a supplement to Medicare and not a stand-alone policy.

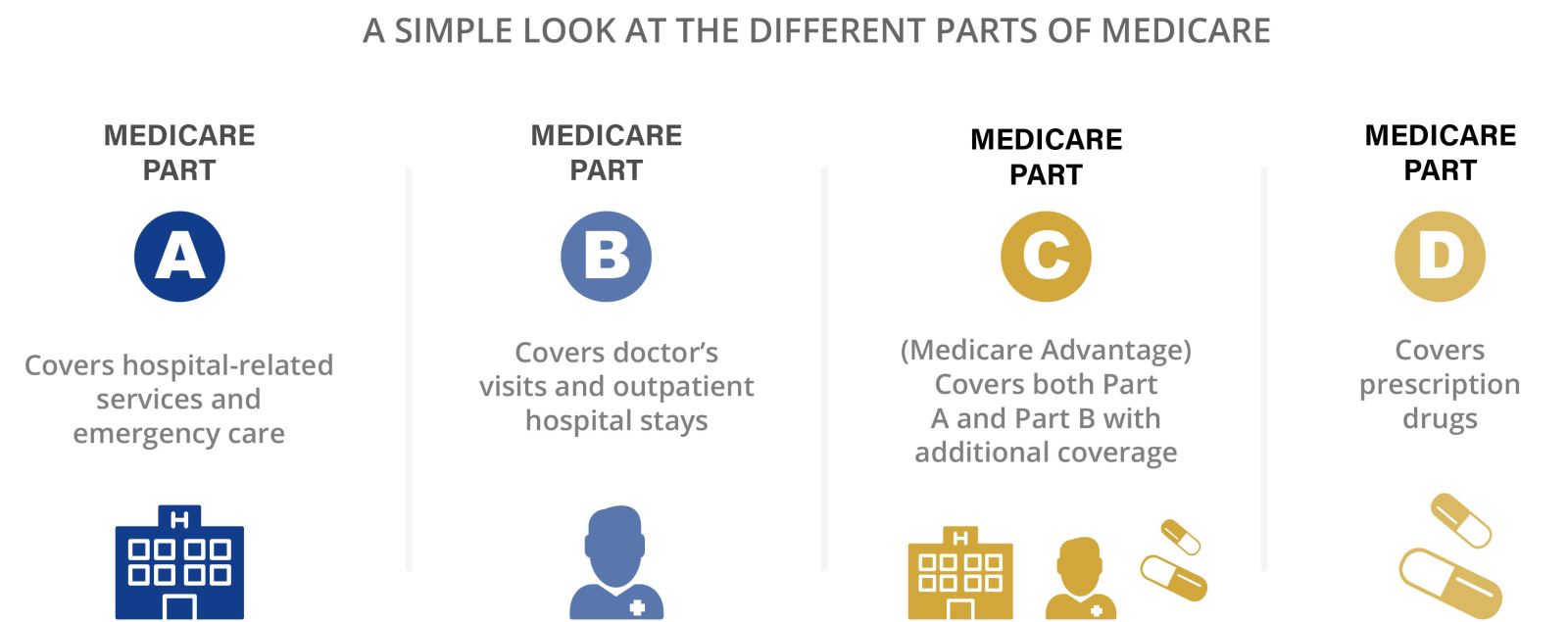

Medicare has actually progressed throughout the years and now has four components. If you're age 65 or older and get Social Safety and security, you'll instantly be signed up in Part A, which covers a hospital stay expenses. Components B (outpatient services) and D (prescription medicine benefits) are volunteer, though under particular scenarios you may be automatically enlisted in either or both of these.

Medicare Graham for Beginners

This post describes the sorts of Medicare intends available and their insurance coverage. It also provides suggestions for people that care for member of the family with specials needs or health and wellness problems and dream to handle their Medicare affairs. Medicare is composed of 4 parts.Medicare Component A covers inpatient medical facility care. It likewise includes hospice care, proficient nursing center treatment, and home health care when a person satisfies specific requirements. Regular monthly premiums for those that require to.

acquire Part A are either$285 or$ 518, depending upon the number of years they or their spouse have actually paid Medicare tax obligations. This optional insurance coverage calls for a monthly premium. Medicare Part B covers clinically essential solutions such as outpatient physician check outs, diagnostic services , and preventative services. Private insurance companies offer and administer these plans, however Medicare should accept any type of Medicare Benefit plan prior to insurance providers can market it. These plans offer the same coverage as parts A and B, but several likewise include prescription medicine protection. Monthly costs for Medicare Advantage prepares tend to rely on the area and the plan an individual chooses. A Component D strategy's protection relies on its cost, medicine formulary, and the insurance coverage service provider. Medicare does not.

An Unbiased View of Medicare Graham

generally cover 100 %of clinical costs, and the majority of plans require a person to fulfill a deductible before Medicare spends for medical services. Component D usually has an income-adjusted premium, with higher premiums for those in higher earnings brackets. This applies to both in-network and out-of-network health care specialists. Nevertheless, out-of-network.

treatment sustains extra prices. Medicare Lake Worth Beach. For this sort of strategy, administrators identify what the insurance firm pays for medical professional and medical facility insurance coverage and what the plan holder need to pay. A person does not need to select a medical care physician or acquire a referral to see an expert.

Medigap is a single-user policy, so spouses have to purchase their own protection. The expenses and benefits of different Medigap policies depend on the insurance provider. When it pertains to valuing Medigap strategies, insurance coverage companies may utilize one of several methods: Costs are the very same despite age. When an individual starts the plan, the insurance service provider elements their age into the costs.

Medicare Graham Fundamentals Explained

The insurer bases the original costs on the individual's present age, however premiums climb as time passes. The price of Medigap intends differs by state. As noted, rates are lower when a person buys a policy as quickly as they reach the age of Medicare qualification. Specific insurer might additionally provide discounts.

Those with a Medicare Benefit plan are disqualified for Medigap insurance coverage. The moment might come when a Medicare strategy holder can no more make their own decisions for factors of mental or physical wellness. Prior to that time, the individual should mark a trusted person to offer as their power of attorney.

The individual with power of lawyer can pay costs, documents tax obligations, accumulate Social Security advantages, and pick or change healthcare strategies on part of the insured person.

The smart Trick of Medicare Graham That Nobody is Talking About

Caregiving is a demanding job, and caregivers often invest much of their time meeting the demands of the person they are caring for.

Depending on the individual state's policies, this might include employing loved ones to offer treatment. Given that each state's policies differ, those looking for caregiving settlement must look into their state's requirements.

How Medicare Graham can Save You Time, Stress, and Money.

The insurance provider bases the initial premium on the person's current age, but costs rise as time passes. The price of Medigap plans varies by state. As noted, costs are reduced when a person gets a policy as soon as they get to the age of Medicare eligibility. Private insurance policy companies may also provide discount rates.

Those with a Medicare Benefit plan are ineligible for Medigap insurance. The moment might come when a Medicare plan holder can no more make their very own decisions for factors of psychological or physical health and wellness. Before that time, the individual should designate a relied on person to act as their power of attorney.

Indicators on Medicare Graham You Should Know

The individual with power of attorney can pay expenses, documents tax obligations, collect Social Safety and security advantages, and pick or change health care plans on behalf of the guaranteed individual.

Caregiving is a demanding task, and caretakers often spend much of their time meeting the needs of the person they are caring for.

Report this page